NeoXam DataHub

The single source of truth

for all data domains.

By responding to data challenges, we allow financial institutions to self-serve with our cloud-based data management solutions, allowing them to receive the data quality they require at any time.

Why the need for data management ?

1

Data is a requirement at all levels of the organization

2

Multiple data domains and data sources needed

3

Lack of data quality and standardization

4

Lack of data centralization, decreasing efficiency, and operational risk

Powering the Global Financial Industry

with Software and Expertise.

NeoXam

MDM

Master Data Management

NeoXam

MRDM

Market & Risk Data Management

NeoXam

IBOR

Investment Data Management

NeoXam IBOR

- Investment Book of Records (IBOR)

- Accounting Book of Records (ABOR)

- Performance Book of Records (PBOR)

Trusted by leaders worldwide

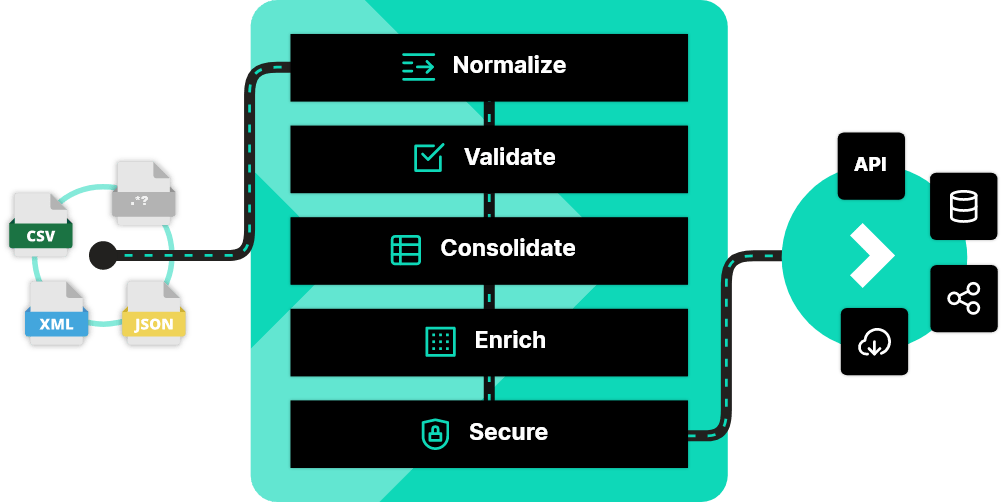

An End-to-End data lifecycle

Pre-configured to most data vendors

Why NeoXam DataHub ?

The most complete, configurable, modern data management platform on the market.

Plug-and-Play

Delivered with an out-of-the-box data model, connectors, and UI.

Configurable

Using parameters or business rules directly through the User Interface.

Using open technologies

To leverage cloud and API capabilities.

Financial Institutions that trust Neoxam DataHub

News

Featured in Global Banking & Finance:

Yann Bloch, head of product and pre-sales Americas at...

04/04/2024

News

Featured in Pensions Expert:

Pension schemes expected fixed income asset classes to top the charts...

04/02/2024